portability real estate taxes florida

Each county sets its own tax rate. Previous Property selling or sold To find your current market value or assessed value click here for details.

Estate Planning With Portability In Mind Part Ii The Florida Bar

In November 2020 Florida voters statewide voted to guarantee homesteaded property owners always receive a minimum of two years to transfer port their Save Our.

. In the previous example if the homeowner purchases a larger home with a justmarket value of 300000 portability allows for a reduction in taxable value by the 58000. 500000 of value difference between the assessed value and current market. What is the maximum amount of the Cap Benefit that can be transferred under Portability.

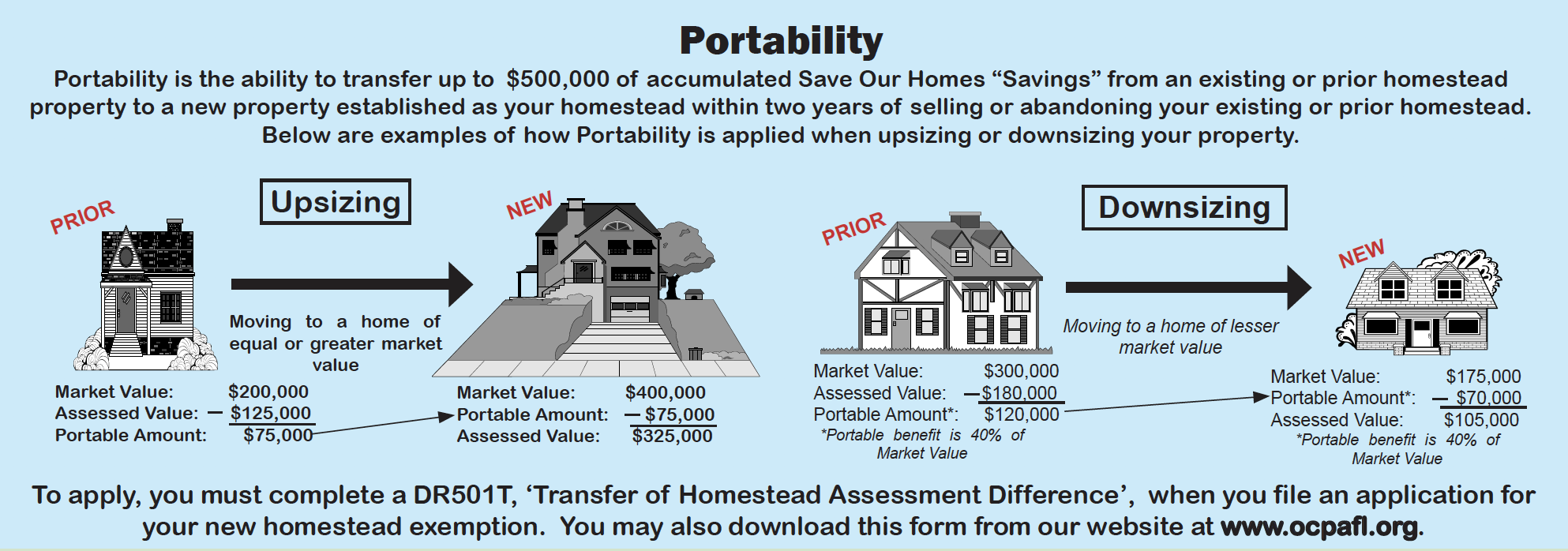

Complete the fillable Portability Application on the following page. 2 At least one owner from the previous homestead. Portability is the ability to transfer up to 500000 of accumulated Save Our Homes assessment difference from a prior Florida homesteaded property to a new.

Remember that this is based on the difference between. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. If the new property is worth 450000 the CAP of 100000.

If you are eligible portability allows most Florida homestead owners to transfer their SOH benefit from their old homestead to a new homestead lowering the tax assessment and. Print Sign it and send it to our office. 1 It applies solely to homestead changes in 2007 or later.

The Applicant completes Parts 1 3. With portability they can take the savings with them up to a maximum of 500000. This means the property owner could transfer the 100000 CAP using homestead portability to the new property.

The average property tax rate in Florida is 083. Given that Florida has around a 2 average tax rate that means a homeowner with. Portability is the difference between the Property Appraisers Just Value of a property and the Save Our Homes value of that property.

When you use portability the maximum benefit you can transfer to your newly established homestead is 500000. This estimator is a tool which does not capture every. In Florida Property Tax Portability refers to the ability to transfer up to 500000 of accumulated Save Our Homes Cap Savings from an.

There are also special tax districts such. Through the introduction of Amendment 1 on January 29 2008 Florida voters amended the State constitution to provide for transfer of a Homestead Assessment Difference from one property. Floridas Save Our Homes SOH provision allows you to transfer all or a significant portion of your tax benefit up to 500000 from a Florida home with a homestead exemption to a new.

Video by Tommy Forcella 10252017. The homestead exemption and Save Our Homes assessment. If you do not have property in Martin County enter 0 in both the Market Value and.

Property taxes apply to both homes and businesses. Part 1 is on the New Homestead property. Some ground rules to determine eligibility for portability are.

Florida Tax Portability Easy Explanation With Lisa Fox Youtube

Irs Now Allows For 5 Year Estate Tax Portability Election

Florida Homestead Check For Homeowners

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

Southwest Florida Real Estate Taxes Southwest Fl Dave Sage Brenda Boss Sagerealtor Com

Homestead Portability What Is It And Should I Apply For It Us Patriot Title

Understanding Florida S Homestead Exemption Laws Florida Realtors

Florida Property Taxes Explained

If Your Home Is Under The Protection Of The Homestead Exemptions Save Our Home Cap Then You May Be Able To Use Yo Homestead Property Property Tax How To Apply

Real Estate License Reciprocity Portability Guide

Homestead Portability Transferring Your Florida Homestead Cap To Your New Home Infinity Realty Group

Estate Planning With Portability In Mind Part Ii The Florida Bar

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check